Each insurer has a different perspective on how to assess natural catastrophe risk when underwriting. That’s why InsitePro lets you design the risk scoring analytic that meets your needs.

Of course, InsitePro includes Intermap’s best-in-class geospatial data, but we also let you add your proprietary information for a risk score that’s customized to your company’s strategy and history.

Datasets that can be used for risk scoring include, but are not limited to:

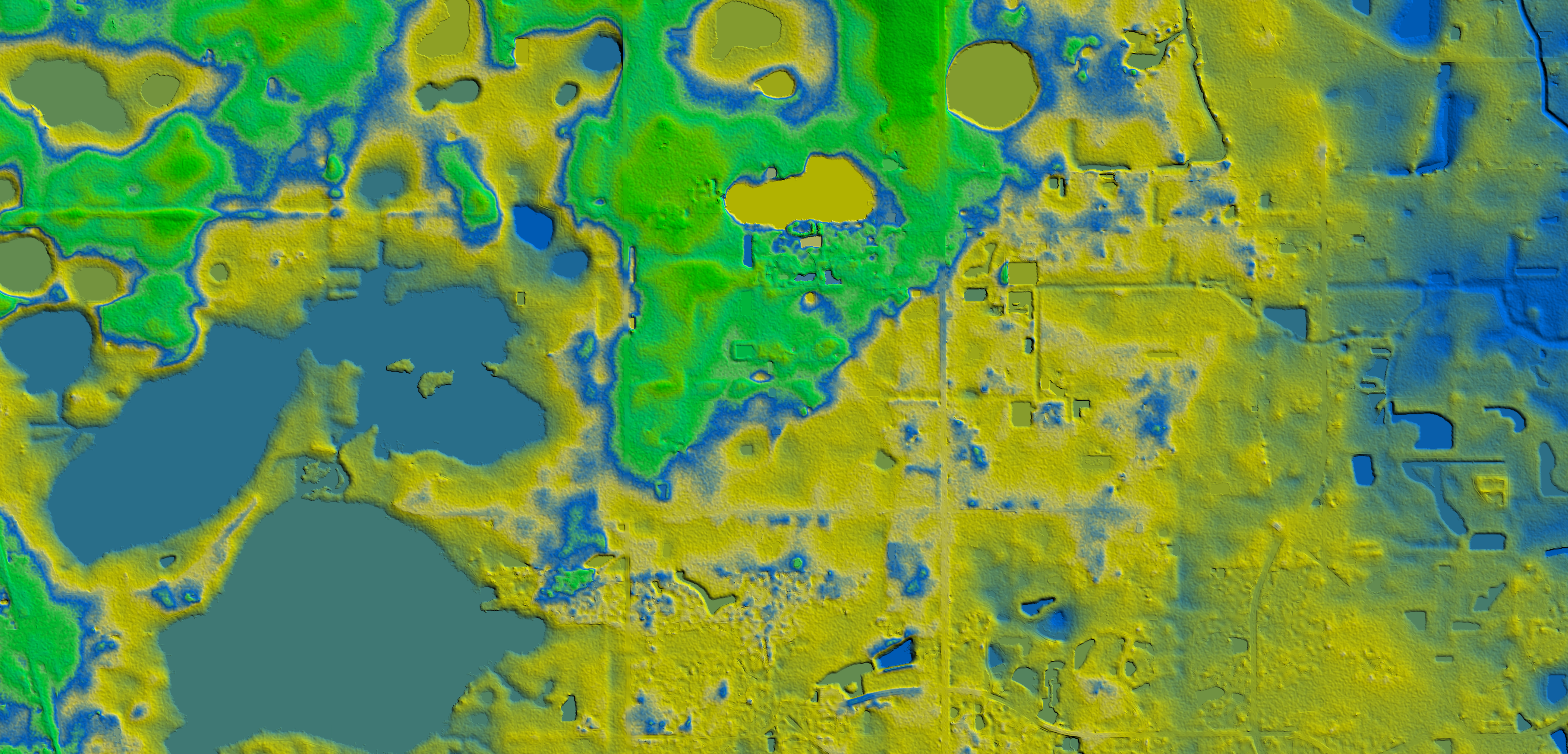

What’s the difference between their 10-meter resolution and NEXTMap® 1-meter resolution? It could be the difference between whether a property will or won’t flood.

For years, InsitePro has relied on the unparalleled accuracy of Intermap’s 5-meter NEXTMap terrain data. We’re now introducing NEXTMap 1-meter data into the InsitePro dataset for the continental United States.

You’re already ahead of the game if you’re using flood risk software in your underwriting practice … but how good is its underlying data? Most packages rely on the USGS National Elevation Dataset (NED) which, on average, has a resolution of 10 meters across the United States. In select areas, it can have up to 3-meter resolution. InsitePro now has 1-meter resolution across the entire United States

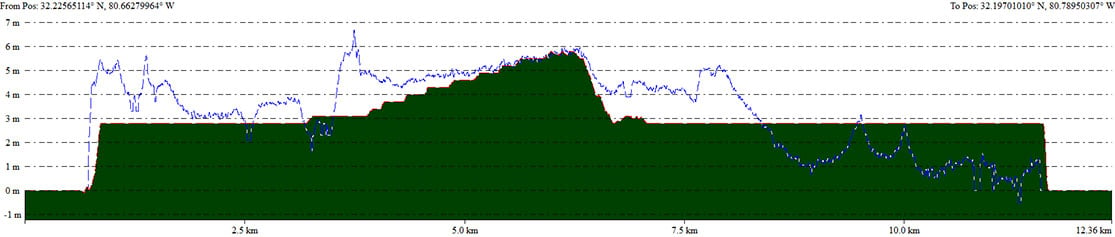

Nowhere is the difference more evident than in the popular vacation area of Hilton Head Island. The example below highlights a cross section of the island where the difference between InsitePro and the NED elevations can be as much as a 3-meter difference – which can mean the difference between profit and loss when insuring properties on a barrier island (blue line represents InsitePro)..