While reading Gallagher’s CEO first quarter synopsis (Best’s, subscription required) I was interested by his thoughts on the flat rate market in property insurance:

"I've never lived this way before," he said. "It's either one way or the other, where you've got rates coming down substantially and you're shopping everything, or rates are going up and you're scrambling to get the coverage you want."

He continues by describing how comfortable he is in such an environment because his company is built for competition: “Give us a stable rate environment and … we will drive organic growth."

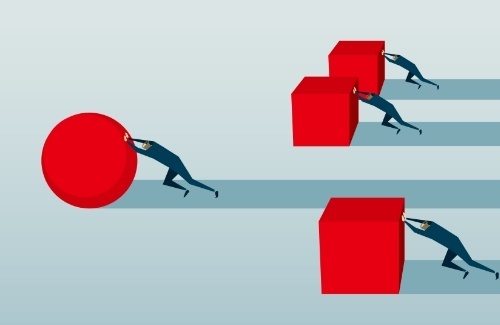

This is an attitude that all successful brokers, carriers, and reinsurers will need to emulate. Successful companies will succeed on their competitive merits for the foreseeable future. Here are three ways property insurance underwriters can gain a competitive advantage in this market.

1. Invest in risk software solutions, like InsitePro, that offer analytics to let them leverage every scrap of data they have to the maximum benefit.

2. Reduce underwriting leakage, which helps reduce costs and increase efficiency.

3. Improve an existing book of business by finding new properties for which the open market might be overestimating the risk, and shedding properties from their portfolio that are riskier than they might have first thought. Risk scoring can be used for both of these types of initiatives.

A twist to this narrative is the possibility that better analytics are partly responsible for the flat rates. Take a look at this video filmed at the RIMS Annual Conference in New Orleans in April. It features Jamie Miller, Managing Director and Head of Property at Swiss Re Corporate Solutions, expressing the opinion that better modeling is responsible for the current market conditions. It makes sense that widely available and improved analytics lead to stable and predictable rates, because they are being used more widely, delivering rational information, and being interpreted consistently.

However, it’s a mistake to think technology has solved the market fluctuations of property insurance. Innovation will continue to drive competitive advantages for those who embrace it. In property insurance, this is even more pronounced because of the prevalence of certain models for certain perils.

Those who can innovate beyond the standard data and analytics will do well in this market. In fact, they’ll do well in any market.

.png?width=500&name=InsitePro4%20(1).png)

Comment Form