Early last month RIMS published a great article called Flaws in the Data – it’s about data, analytics, and “data driven decisions” (another term for using data in analytics). From the start, it was begging for a blog post, but all the action on private flood (missed it? try this, this, and this … and even this) has consumed us here for the past month. Let’s take a look at what “flaws in the data” is about.

The crux of the article is that more and more businesses are investing (hugely) in collecting data, and then exploiting it to make better decisions. Pretty uncontroversial stuff:

Cutting-edge companies like Amazon, Google, Netflix and Uber have exploited data from the get-go, developing advanced models and algorithms to facilitate business decisions, and are leaders in the persistent use of data collection and analysis.

Because:

Ultimately, the effort can also help to put a business on the path toward the wider use of predictive analytics and automation systems, including machine learning and artificial intelligence, which could lead to faster and more efficient decision-making.

Right? Cool!

But here is where it gets interesting:

If not developed with clear goals in mind, regularly monitored and updated properly, data-driven decision-making and its attendant models and algorithms can produce poor, unacceptable or even disastrous results.

Really? Like this, for example?

The 2008 financial crisis offers an example of the drawbacks to relying too heavily on data models. “There were companies engaged in mortgage lending who had hard-coded into their models continuous home price increases of 4% a year for as far as the eye could see,” said Kevin Buehler, co-founder of McKinsey’s global risk practice and leader of its risk advanced analytics group. “Clearly, those models did not perform well when home prices fell.

Yikes.

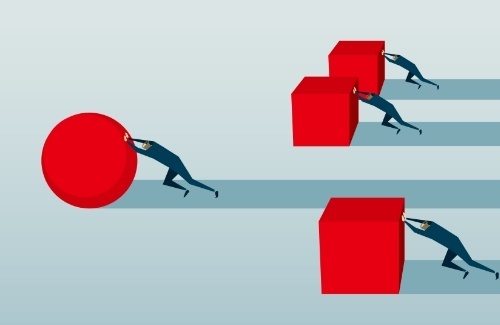

Here’s the problem: analytics (especially predictive ones) are models (which are always wrong, but sometimes useful), and whatever benefit they bring will be ENTIRELY dependent on the quality of data fed into them. If you feed flawed data into an analytic that is imprecise, get ready for ruin because falsely approximating reality with dodgy data is not a recipe for success.

However, if you have accurate, verified data, you can glean real value out of analytics in spite of their shortcomings. And, better yet, if you have access to accurate verified data that your competition doesn’t have, you can create real advantages for your business. For the companies listed above, there is no such thing as accurate verified data, so it is a constant race to refine the data they collect.

Happily for flood underwriters, accurate verified data IS available, as are the analytics to exploit it fully. You just need to know where to look.

.png?width=500&name=InsitePro4%20(1).png)

Comment Form