As risk assessments get better and better, the limiting factor on how well they work is almost always geocoding. A long time ago, we took a look at geocoding for underwriting, which discussed how important it is. Well, everything in early 2015 that was true and valid remains true and valid.

But, having integrated geocoding for a number of underwriters now, we have learned more about how it works in an underwriting workflow. Here are the two main lessons we’ve learned:

- It is essential that geocoding that is integrated with an automated system uses quality metrics to describe the dependability of the coordinates being delivered, and to use those metrics in the actual underwriting logic. The sureness of the location is every bit as important as the actual risk information to be used in underwriting, and it should all be considered together.

- Geocoding for underwriting is a trade-off between efficiency and accuracy. Underwriting processes that use a broad swath of geocoding qualities can work automatically with little interruption. But, as the acceptable quality is tightened, more and more risks will not be automatically assessed and will create more work for people to do. Every underwriter needs to define this balance of accuracy vs efficiency, which are both sources of underwriting leakage.

In the end, geocoding is a bit of a necessary evil for underwriters – especially those using automated systems. But it is also an opportunity to create a competitive edge – after all, if it was easy, anyone could leverage it perfectly.

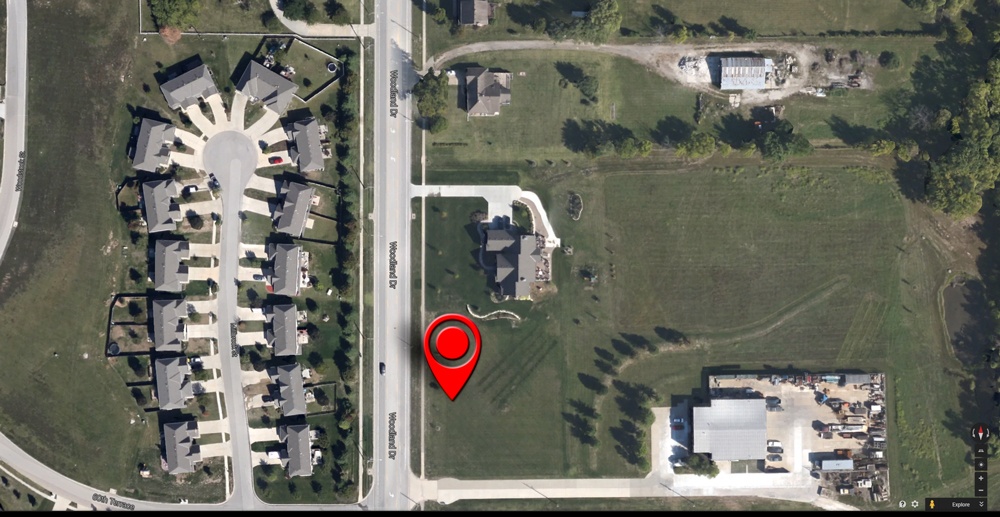

.png?width=500&name=InsitePro4%20(1).png)

Comment Form