One of the best talks I’ve heard on insurance innovation is The Changing Landscape of Risk presented by Robert Schimek of AIG (SVP and CEO of Americas Region). He was speaking at MarketScout’s Entrepreneurial Insurance Symposium in Dallas in December.

The fact that only the people in the room, plus 63 people on YouTube, have heard it is a shame. It is super informative, very entertaining (on the Insurance Technology Lecture scale), and (for me) it accomplished the elusive goals of a good talk: it asked questions that changed the way the audience thought of problems, and provided answers to questions the audience didn’t know they had. As a bonus for blog writers, it is a gold mine of material – I will be visiting Mr. Schimek’s material over and over.

The overall subject of the presentation was the importance of entrepreneurial innovation in insurance. He had to lay a little groundwork, because AIG’s view of innovation is likely to be different from pretty much the rest of the industry’s; i.e. 63,000 employees and they pay ~ $110M in claims every day…not quite your typical insurance company. Because of this, he is also able to bring some interesting holistic macro viewpoints to the conversation.

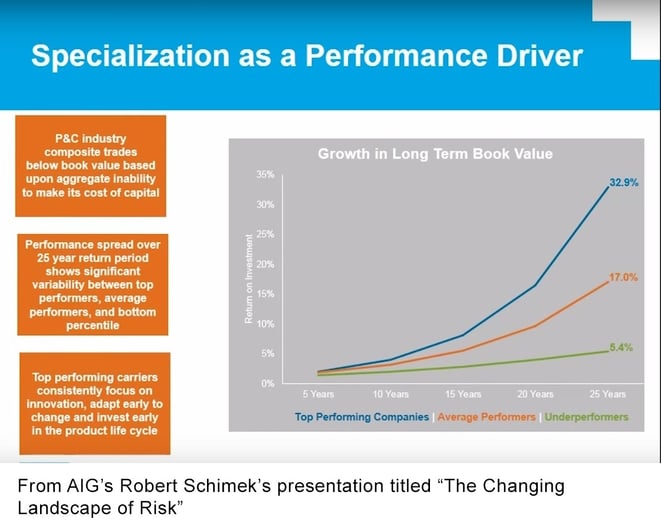

His thoughts on the value of innovation really captured my imagination. He showed a slide (below) that quantifies the ROI on “specialization.” This is not “specialty” insurance, but rather, the ability to do something really darn well.

The concept is that innovation enables this type of specialization, and over time there is a measurable difference between companies that perform well in an area of specialization (as measured by their ability to cover the cost of capital), and those that don’t. For the first few years, there is little difference, but over time the ROI spreads wide and fast.

This chart rang a bell for me because I have always found it hard to quantify the value of using underwriting analytics to improve a portfolio over time, because:

- Effective underwriting tools do not necessarily increase the amount of premium collected, and actually reduces it in some cases.

- A reduction in claims manifests itself over time (i.e. decades, like the scope of this chart).

- The accurate assignment of premium to risk also takes long periods to manifest in profitability.

These benefits, and the ROI they can deliver, are the main reasons to upgrade underwriting analytics, along with the cost savings of increasing efficiency. Until I saw this chart, I couldn’t quantify that innovation. Happily, Mr. Schimek did it for me.

.png?width=500&name=InsitePro4%20(1).png)

Comment Form