All the Possible Ways

In 2014 Deloitte published a research paper entitled The potential for flood insurance privatization in the U.S. Could carriers keep their heads above water? A few days ago, we did an overview with a deep look at the key problem and solution. Today is a review of their survey of all the available ways that private flood can be introduced into the US market.

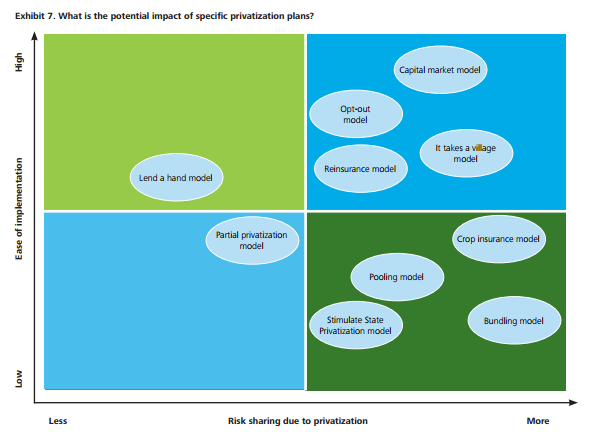

Below, in the graphic from Deloitte, are the ten possible ways for private flood insurance to happen, all plotted on a chart depicting increasing Ease of Implementation and Risk Sharing (page 11 of the report).

There they are: ten ways to introduce private flood. There might be more, but I can’t think of any. In the report, each is defined. Let’s take a look at a selection of them:

- The “Capital market model” offers the easiest way into private flood while bringing almost the most risk sharing. Essentially, this model is based on what was called “alternative capital” up until last year (now, it’s just called “capital”), whereby risk is diversified into the markets using cat bonds and other financial devices. This would be easy to do because cat bonds are now well established financial instruments, and they are a very effective and predictable way to disperse risk. This type of private flood is happening now, sometimes excluding traditional insurers altogether.

- The most common form of private flood insurance now is the “Partial privatization model,” also known as cherry-picking. It is not surprising to see that cherry-picking is ineffective at risk sharing, but it is surprising to see that it’s in the less-easy half of the options. The ease of implementation is one reason that so many carriers and syndicates are now cherry-picking.

- The “Bundling model” is deemed most effective at risk sharing and is also deemed the most difficult to implement (along with the “Stimulate State Privatization model,” which seems like a silly idea). This model would have flood as a standard peril on all homeowners’ policies, regardless of the flood zone maps. The U.K. currently runs on this model, so there is some insurance industry experience with it. The obvious pros of this model are the vast reduction of the coverage gap, and the end of the dependency on universal flood maps for insurers. I agree with the report that this would be the most effective way to share the risk, but I’m not so sure it would be the hardest to implement. The tools exist now to rate every piece of property in the US for flood risk, and it is largely inertia that prevents it from happening.

The other models are all very interesting to read about (like the “Crop insurance” and “It takes a village” models), and the fact these authors found 10 possibilities is commendable. We are likely to see more cherry-picking and capital market activity in the near future, though. And the day will come soon that bundling will be the solution, because it really is the best way to handle the risk for the industry.

.png?width=500&name=InsitePro4%20(1).png)

Comment Form