Geocoding, the attribution of geographic coordinates to a postal address, is a geospatial problem people have been trying to solve since the advent of GIS in the 1960s. Reliable geocoding has always been a concern in the property insurance market: After all, the first step in understanding the risk at a location is to know exactly where that location is. But in the last 15 years it has also become a concern for the consumer market, with Garmin’s perfection of consumer GPS location hardware and the ubiquitous Google Maps platform availability over phone networks. (Personal note: This amazes me. When I studied Geomatics in university in the ‘90s, it required 20 lbs of equipment worth thousands of dollars to match the positioning capability of my cell phone!)

The rapid expansion of available geocoding capabilities brought on by consumer demand has proved to be greatly beneficial to property insurance solutions. With increasingly available geocoding, software for property insurance has been able to grow from databases and paper maps, to GIS systems, and onward to sophisticated spatial tools that provide information to non-technical users. But geocoding remains imperfect. In fact, there are several problems.

Problem 1: Incomplete Coverage

While the quality and amount of geocoding information available for the world is astounding, it is far from complete. The main shortcoming of geocoding remains coverage. There are still places in the world with sparse geocoding information available, and even in well geocoded regions, construction booms mean that every new building needs coordinates attributed to it. The purveyors of geocoding information are continually updating their databases to be as current and complete as possible.

Problem 2: You Don’t Know What You Don’t Know

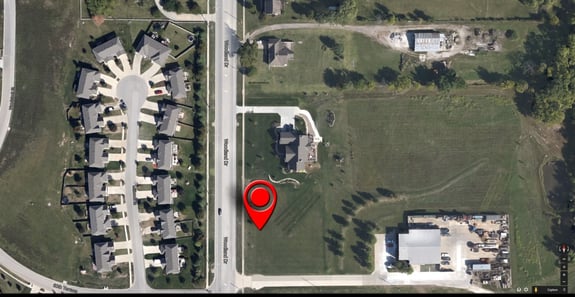

The conundrum with incorrect geocodes is that they are only detectable if you already know the answer. When software converts a postal address to a pin on a map, it is impossible to know if the pin is in the correct place without knowing where it should be. For insurers, this is a serious, if infrequent issue (depending on your software) because you might never know you are working with a completely wrong location. It’s always good to validate somehow that the location is actually correct. (Google’s Street View is a handy tool for that.)

Problem 3: User Error

The complexity of postal addresses varies widely, and mistakes do happen when entering a street address. Fortunately, some geocoding software provides a quality metric along with the coordinates, which can account for mistyped or ambiguous addresses to reduce confusion and to draw attention to addresses that might need correction or validation. Since different regions around the world are geocoded to different accuracies, the quality metric is very helpful to understand if the location is precise or approximate. Typical quality outputs would be “levels” of geocoding, such as building-level, street-level, postcode-level, or even city-level.

Why It Matters

Ultimately, for property insurers, geocoding is another source of uncertainty that must be addressed. This issue is sometimes illustrated in their transaction with reinsurers. If an insurer uses a different geocoding engine than their reinsurer, with different quality of output, there can be a disconnect on the risk at stake due to the evaluations being done by the two parties on different locations. Better geocoding leads to better understanding of risk, but discrepancy can be as expensive as uncertainty.

Geocoding is largely taken for granted by almost all the people who use it. For insurers, the potential cost of incorrect geocoding is too great to be complacent. As I said before — the first step to understanding the risk at a location is to know where that location is. If this first step is done incorrectly, nothing can redeem the subsequent analytics.

.png?width=500&name=InsitePro4%20(1).png)

Comment Form