Last week I took a look at the Top 5 Risks of Hazard articles from 2015. Today, here is a look at the Top 5 Accomplishments of InsitePro™, the risk assessment software we are building here when not writing blog posts.

5. API connectivity. Insurance software is slowly but surely moving towards interconnectivity between disparate systems and software packages. Not everything is in the cloud (yet), but almost all insurance systems are able to integrate analytics and datasets. InsitePro fits this type of environment with its full suite of APIs and web services, plus it is based in the cloud and waiting for the industry to realize the benefits there.

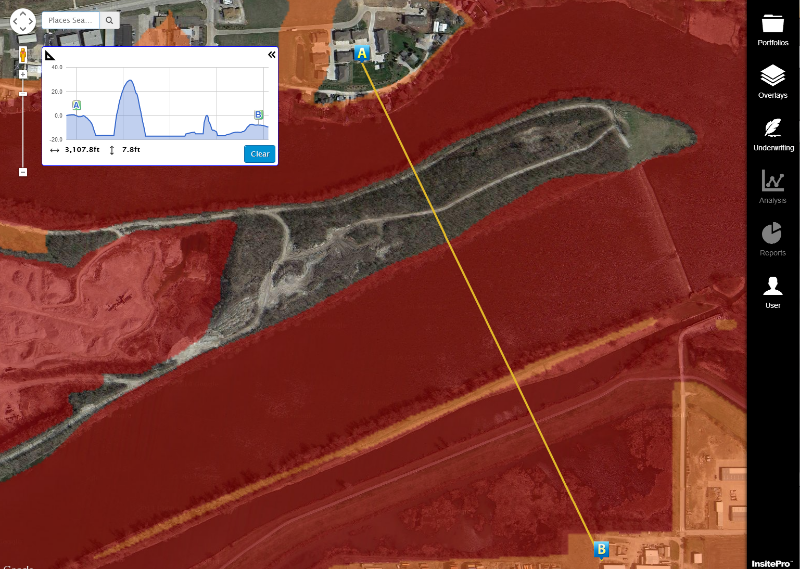

4. Water locations. When assessing flood risk, it is very useful to know the relationship between a property and the nearest source of flooding. To enable that analysis in InsitePro, we have created a comprehensive dataset that defines coasts, lakes, and rivers. Now, underwriters can know not only the distance to a nearby river or stream, but the height of the property above the water. This is also an example of our ability to match unique datasets with analytics, rather than depending upon publicly available datasets.

3. Wildfire and Earthquake. InsitePro is not a flood-specific tool, but rather can handle any nat cat peril. In 2015, we signed agreements with Atkins and Anchorpoint to make available earthquake and wildfire data suitable for underwriting. More perils are coming in 2016, including hail.

2. FloodScope™. In June, we released into InsitePro the first nationwide (well, except for Alaska), USA flood model based on five-meter resolution, high-quality bare earth elevation data. Like all flood models, it’s not always right, but it is a powerful tool for improving flood underwriting.

1. Customized scoring analytics. This is not only the most important development for InsitePro in 2015, but I would suggest (maybe with a bit of bias) that it is the most important advance in nat cat risk assessment of the past 5 years. Insurers can now underwrite with the datasets they trust, in the specific way they have learned to best use them, using their very own view of risk and appetite level. The approach has excited our customers, and underwriters in the US and in London are beginning to explore the possibilities with us, particularly for underwriting flood.

It was an exciting year in 2015 bringing InsitePro to market. The combination of new sources of data and configurable analytics is a strategy that should ensure 2016 shapes up to be even more exciting for insurance technology and InsitePro.

.png?width=500&name=InsitePro4%20(1).png)

Comment Form