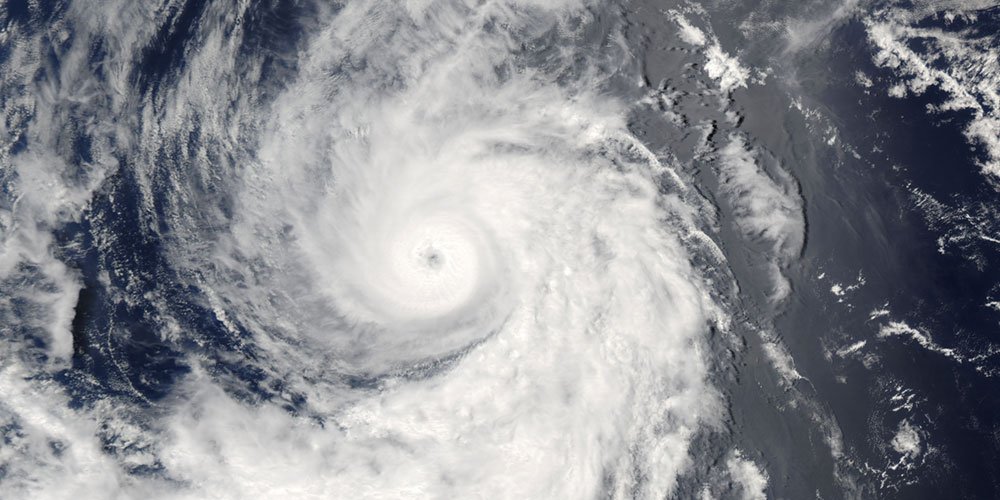

Property insurers rely on many types of tools for risk analysis, but none quite so complex as the cat model. Short for catastrophe, cat modeling uses computer-assisted calculations to estimate the losses that could be sustained due to a catastrophic natural event. Perils analyzed include flood, hurricane (wind damage and storm surge), earthquake, tornado, hail, wildfire and winter storm. The principle function of cat models is to help insurers prove their financial solvency.

Clarity in an Otherwise Clouded Picture

While most large companies, financial or otherwise, can prove and convey their solvency with accounting metrics, property insurers have a more difficult task. At renewal time, when they write the bulk of their policies, insurers are flush with cash as they collect premiums from their customers. An accounting snapshot would seem to show that they have enormous cash reserves and investments, but no obligations. In reality, their obligations are the claims they need to pay over the next year as the properties they are insuring are damaged. But the problem is that nobody knows how many claims they will need to pay.

Cat models solve this problem by calculating several statistical figures based on a carrier’s portfolio of insured properties. The two most significant are:

- Probable Maximum Loss (PML): An estimation of the most likely worst case for any given year. (Notice this is different the Maximum Possible Loss – that figure would be the entire portfolio being destroyed, which is very unlikely.)

- Annual Expected Loss (AEL): An estimation of how much the insurer can expect to pay in the coming 12 months.

Cat models arrive at these calculations by utilizing three interconnected modules: hazard, exposure and financial.

- The hazard module estimates the risk of natural catastrophes affecting each of the locations within an insurer’s portfolio. Which perils are evaluated depends on the location of the properties, with flood, earthquake, and wind/hurricane being the most common.

- The exposure module takes the hazard information and translates the chances of something happening into monetary values based on the physical attributes of the properties. Factors such as construction material, what the building is used for, and what is inside the building are all used to calculate the exposure.

- The financial module converts the exposure information into the output specifically needed to convey the solvency of the company; i.e. the balance between money available to pay claims and the amount of claims they might need to pay. These calculations are based on policy information (premiums, deductibles, and limits).

Predicting the Future

At the heart of all this is an estimation of what might happen in the coming 12 months. Monte Carlo statistical methods are used to create “event sets” — vast sets of different global scenarios that might happen in a given year based on the likelihood of each little aspect (including meteorological and climatic conditions) of a scenario happening. These statistical, or stochastic, methods allow the cat model to have a proxy for millennia of experience that is, of course, impossible to have based on reality.

Grain of Salt

Of course, we must always remember the words of George Box: all models are wrong, but some are useful. As sophisticated as they are, cat models are never accurate because it is impossible to estimate how a real natural catastrophe will impact property. Indeed, every event tends to expose a gap in the models.

For example: For super storm Sandy, the cat models expected the ports of New York to suffer flood losses only on the containers on the bottoms of the stacks on their docks. Unfortunately, all the containers were positioned on the docks to avoid the wind blowing the stacks over. Therefore that additional loss was unaccounted for.

During the same storm, the cat models underestimated the potential losses resulting from the fact that many buildings in Manhattan have their IT infrastructures located in the flood-prone basements.

Meanwhile, in this year’s earthquake in Napa, California, some models did not account for the racks of wine barrels stacked high in the cellars coming tumbling down and shattering, which resulted in Business Interruption claims.

Nonetheless, the cat models perform amazingly well considering the raw complexity of what they do. All cat model vendors employ extremely bright minds to solve staggering statistical problems in a way that does the unthinkable – they predict the future with surprising good success.

.png?width=500&name=InsitePro4%20(1).png)

Comment Form